when does draftkings send out 1099|Key tax dates for DraftKings : Baguio Forms 1099-MISC and Forms W-2G are expected to be available online at the . Logitech G HUB is new software to help you get the most out of your gear. Quickly personalize your gear per game. . Program buttons with in-app actions and create your own macros to launch media and switch scenes. Use your gaming gear to take command of OBS Studio for a faster and more seamless stream.

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Taxes on Draftkings/Fanduel. I'm confused : r/dfsports

PH4 · Tax FAQs – DraftKings Help Center (US)

PH5 · Tax Considerations for Fantasy Sports Fans

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH8 · Question for those that have actually received a 1099

PH9 · Never got tax form from fanduel/draftkings. Please help

PH10 · Key tax dates for DraftKings

PH11 · DraftKings Tax Form 1099

Below, we continue our NFL odds series with an over/under win total prediction for the Carolina Panthers. After an abysmal 1-4 start last year, Carolina fired coach Matt Rhule, who finished with a .

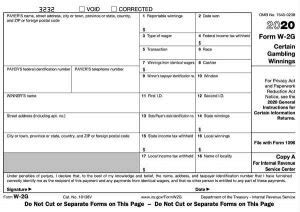

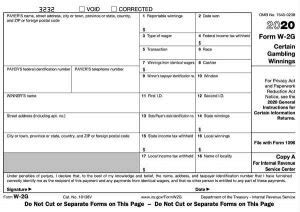

when does draftkings send out 1099*******If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax forms no later than January 31, 2024.when does draftkings send out 1099If you have greater than $600 of net earnings during a calendar year, you .Key tax dates for DraftKings If you have greater than $600 of net earnings during a calendar year, you .

Forms 1099-MISC and Forms W-2G are expected to be available online at the .(US) How do I opt in to electronic-only delivery of tax forms (1099/ W-2G) from .If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings .Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as .

Does the 1099 tax form only show the total of the amount of money you've won on bets, or does it show the amount you won MINUS the amount you lost? In other words let's say I .

When will you receive your 1099? 1099 forms are also due to recipients on January 31. You should receive yours by mid-Februrary. What if you don’t receive a tax .

If you have already sent your income tax return and didn’t claim DFS income, you may need to file an amended return. If you need help locating your DraftKings Tax Form 1099, we have a handy guide .You are only going to get a tax document if you net out more than $600. If you netted out more than $600 on fanduel and there is no tax form available for you to download, .I never get my taxes back. I just had to pay yesterday before the deadline on Monday. Every year I get a 1099-MISC from DraftKings and have pay a shit ton of taxes. Might .

Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a .(US) How do I opt in to electronic-only delivery of tax forms (1099/ W-2G) from DraftKings? (US) Am I taxed on my DraftKings withdrawals? (US) What are the 1099-Misc reporting .

Question for those that have actually received a 1099 from a sportsbook. QUESTION . Does the 1099 tax form only show the total of the amount of money you've won on bets, or does it show the amount you won MINUS the amount you lost? In other words let's say I bet with Draftkings and the total of all my winning bets was $7000, but I also lost .If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best place to play daily fantasy sports for cash prizes. Make your first deposit!

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal .when does draftkings send out 1099 Key tax dates for DraftKings Get insight from other users on your lineups, who you should sub in/sit out, and other information about DraftKings. Members Online • . Does anyone know the time frame of when Draft Kings sends out 1099-Misc forms for winnings? My husband withdrew $539 in winnings but he technically won over $600 so I have a feeling they’ll send us a 1099 .Taxes - Frequently Asked Questions - W-2G, 1099, winnings and more. This FAQ covers frequent tax questions that we receive about our Online Sportsbook, Daily Fantasy, Racing, Faceoff, and Online Casino products, and the IRS-required “Tax Forms” associated with your play on our products. This FAQ is intended to provide general answers to .I’m pretty sure I won over 600 last year on draftkings. I haven’t received a 1099 yet and based on filing deadlines I believe I was supposed to by the end of janurary. . DK will only send 1099 if your NET earning is $600. . jap5531 • I think I did net out 600. Although it may have been split between draftkings DFS and Sportsbook. I . Yes, DraftKings does send tax forms to its users under certain conditions. According to DraftKings’ official website, they will provide Form 1099-MISC to users who have accrued at least $600 in net winnings during the calendar year. This form is used to report miscellaneous income to the IRS.If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal, CashApp, Zelle, or Venmo, the reporting form may be a Form 1099-K.

John Charles Layfield (born November 29, 1966), [1] better known by the ring name John "Bradshaw" Layfield, [2] [3] is an American retired professional wrestler and football player.He is currently signed to WWE, .

when does draftkings send out 1099|Key tax dates for DraftKings